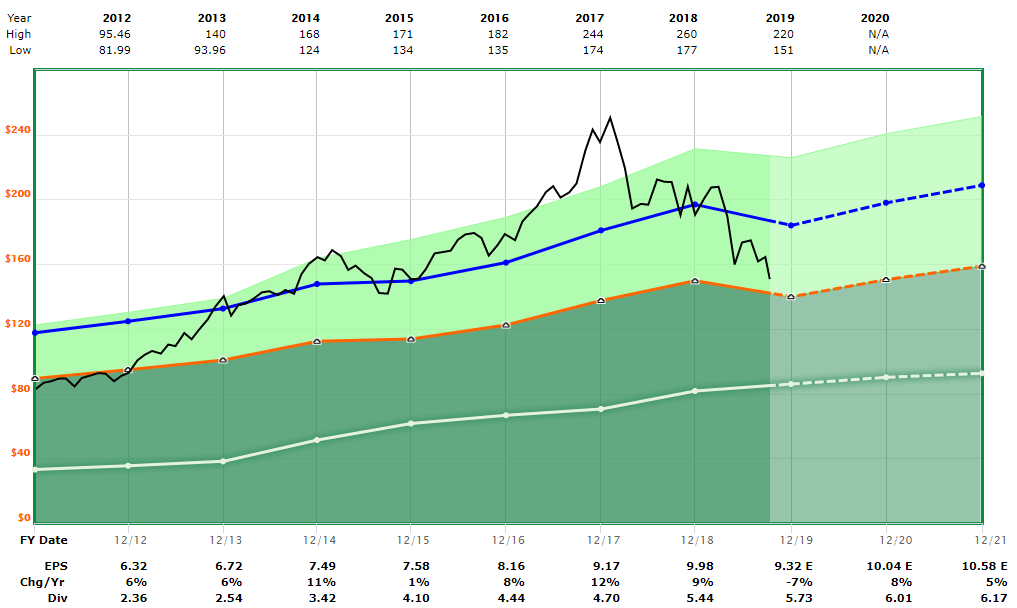

On July 28, 3 M Business (NYSE: MMM) scored income per share calculated, but its stock went below its 50-day and 200-day SMAs. At this point the 3 M stock settled at $152.54 across the quarter. 3 M will be a multinational group in the fields of technological, defense, health care and shopping goods, officially known as Minnesota Mining and Manufacturing Company. The stock closed on Tuesday Aug. 4 at $151.21, down from 14.3% to 17.2% below the 14 Jan. tall of $182.54 in the remedial region.3 M still has a 32.6% bull showcase domain on the 23rd Stroll, but the stock unite a drop of 37.5% from $182.54 in the 14th January to a 23rd of $114.04. His chart is pessimistic week after week.

With P / E of 17.76 and a liberal benefit of 3.91 per cent, the stock is calculated sensitively. The profile is one of the Mutts of Dow’s 2020 stock, a part of the Usual Dow Jones dynamics. A diminishing SMA of two hundred days is seen in green every day for 3M. Two hybrids were present – a 50-day SMA rose on January 16, over the 200-day SMA, after which a flying cross was claimed. This flag powered the inventory to his $114,04 walk 23 moo. On April 7, the V-shaped foot of that moo took the stock back to its 50-day SMA.

NYSE: MMM at https://www.webull.com/quote/nyse-mmm crested as the fizzle measure for its 200-day SMA at the time of 28 April at $163.08. Since then, the 200-day SMA has been a magnet with a low of $131,12 on 14 May and a high of $169,54 on 8 June.

Techniques of trading:

The chart for NYSE: MMM is pessimistic on weekly basis, with a typical moving stock of 154,73 $below five weeks. The stock drop way below its 200-week SMA, or $190.28 turnaround to the cruel one. Moderate stochastic perusals are expected to decrease from 67.10 at July 31 at 12 x 3 x 3 week per week to 63.50 this week.

Acquisition of 3 M Corporate stocks for shortcomings of $142.82 and $138.26 from week to week and month to month. Decreased performing properties at $158.35 for their 20 day SMA. The rotation is $152.54 per cent.

The level was created in the third quarter 2020 based on 30 June and 31 July was defined for Eminent month-to-month. After the end of each week, unused week after week levels are measured, while typical quarterly amounts exist at the end of each year. Semiannual thresholds will be increased at the middle of the year and annual requirements will occur over the year. You can check more stocks like NYSE: MPC at https://www.webull.com/quote/nyse-mpc before stock trading.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.

More Stories

Mobile Oil Change Businesses Are Very Hard to Succeed In

Oracle PL/SQL Developer Certification: 1Z0-147 or 1Z0-144?

Computer Technology and Progress