The huge photograph: In circumstance you were not having to pay consideration, Apple is now a bank. I jest, but only a tiny. It started with the Apple Card, and now the tech large wants to hold your money, way too. Of program, it is absolutely optional, but it does have some advantages if you are by now an Apple cardholder.

As of Could 2021, there have been 6.4 million Apple Card buyers. Backed by Goldman Sachs, the all round assistance is common for its convenient capabilities, together with Apple Fork out and wallet application integration, actual-time balances, on-product account administration, dollars again, and safe card/CVV numbers.

Apple Card has been profitable sufficient that Cupertino now desires to maintain your price savings. On Thursday, the company declared it would quickly provide “significant-produce” financial savings to Apple Cardholders.

“Apple introduced a new Personal savings account for Apple Card that will allow for users to conserve their Daily Income and mature their benefits in a higher-yield Price savings account from Goldman Sachs,” Cupertino mentioned.

This is how it operates. Apple Card is presently established up to give end users a few p.c again on Apple purchases (in-retail store or digital) and two per cent for transactions with collaborating sellers like Walgreens, ExxonMobil, T-Mobile, and many others. All other charges get a one-% return.

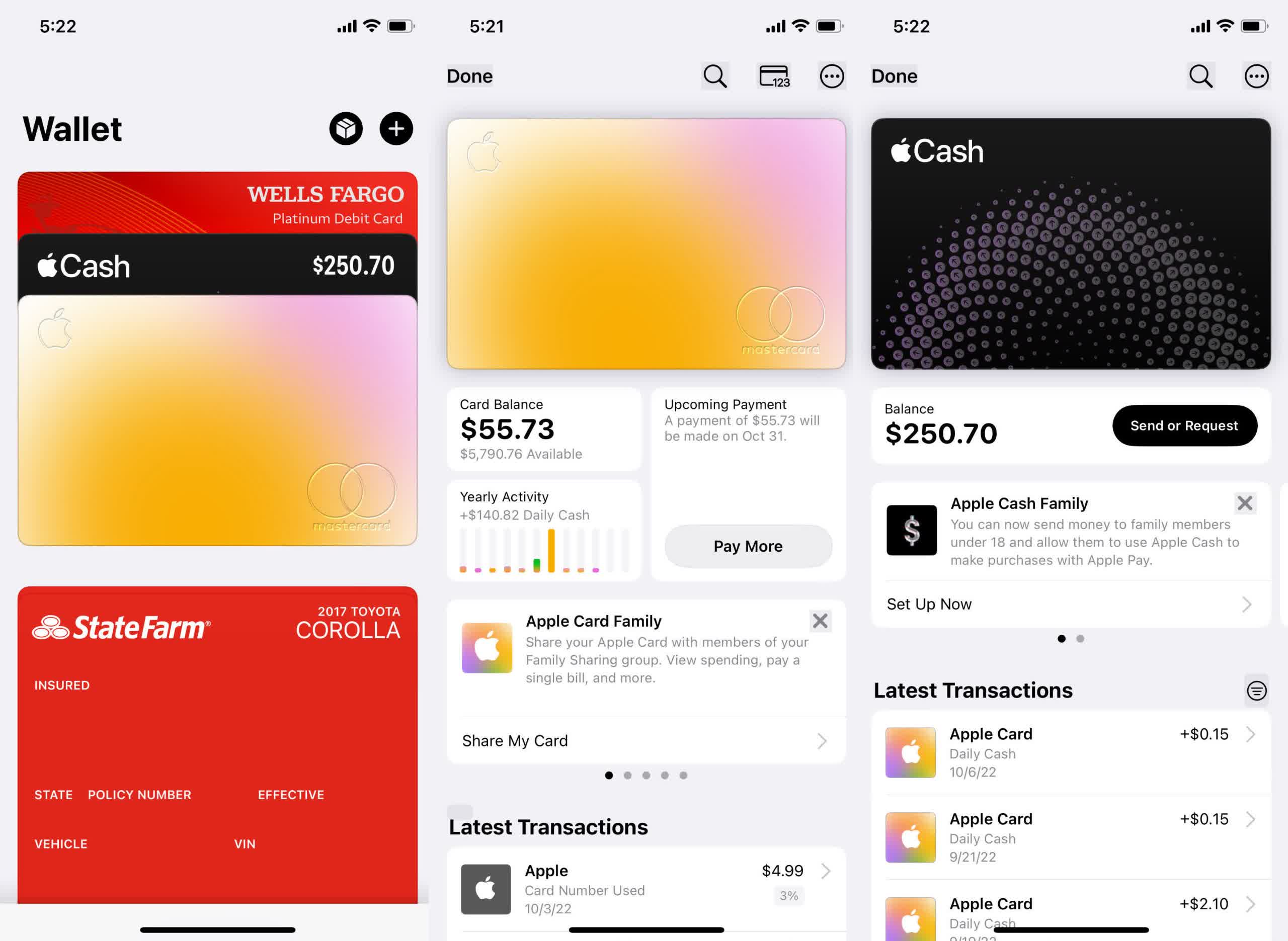

At the moment, this dollars is stored on a separate virtual card in Iphone owners’ wallets referred to as “Apple Cash.” It acts like a pre-paid debit card drawing from the Apple Hard cash equilibrium. Consumers can also transfer resources to their typical bank account. In other text, the money sits there until eventually they do a little something with it.

Apple is proposing to place that funds into a large-yield Goldman Sachs discounts so that it can gain even additional. As soon as people established up an account, Every day Funds will instantly commence depositing into the discounts alternatively of Apple Income. Nonetheless, prospects can still decide to have the cash go into the virtual card if they like.

“Customers can transform their Everyday Hard cash location at any time,” the press release reported.

Apple didn’t outline “significant yield,” but something is much better than very little, which is what most financial institutions give patrons on price savings accounts. The characteristic may possibly be one more engaging perk for Apple Card buyers if it is really actually higher-yield, primarily considering the number of banking companies that even now provide fascination-baring accounts typically offer appreciably fewer than one percent.

Like all cards saved in the Wallet application, the discounts account will have a administration display with similar solutions like viewing benefits and other pursuits. Customers can also transfer cash to and from their connected checking accounts (made use of for creating Apple Card payments), making it like a standard income deposit account, just with no the brick-and-mortar bank.

Escalating the expansion probable of Every day Money is a great small incentive to set aside a minimal “totally free revenue,” specially for all those that not often touch it anyway. It could come in useful for unexpected expenses or occasional splurging. If it truly is substantial-yield, it may possibly even be a improved possibility than users’ recent savings accounts. No matter, it is really difficult to visualize current cardholders indicating “no thanks” to further income, regardless of the yield.

More Stories

Computer Programming Basics – Getting Started the Easy Way

Criteria for Choosing a Search Engine Optimization Service GET IT RIGHT!

Looking For the Best SEO Services? Things You Must Do